BRIEF FROM THE RETAIL COUNCIL OF CANADA

About Retail Council of Canada

Retail Council of Canada (RCC) has been the Voice of Retail in Canada since 1963. We speak for an industry that touches the daily lives of Canadians in every corner of the country — by providing jobs, career opportunities, and by investing in the communities we serve.

RCC is a not-for-profit, industry-funded association representing more than 45,000 store fronts of all retail formats across Canada, including department, specialty, discount, and independent stores, and online merchants. The recent addition of our Grocery Division allows us to represent both grocery and general merchandise/drug chain sectors, large and small, in every community.

RCC is a strong advocate for retailing in Canada and works with all levels of government and other stakeholders to support employment growth and career opportunities in retail, to promote and sustain retail investments in communities from coast-to-coast, and to enhance consumer choice and industry competitiveness. RCC also provides its members with a full range of services and programs including education and training, benchmarking and best practices, networking, advocacy, and industry information.

RCC has offices in Halifax, Montreal, Ottawa, Toronto, Winnipeg, Edmonton and Vancouver.

Executive Summary

Despite challenging economic conditions, Canadian merchants have illustrated great resilience and perseverance. The retail sector is Canada’s largest employer, providing jobs for more than 2 million Canadians representing 12% of the workforce. Last year the sector generated sales in excess of $436 billion across Canada. Canadian merchants, both big and small, continue to be a critical component of Canada’s economic recovery.

In 2010, RCC and Industry Canada collaborated on a report entitled The State of Retail. This report clearly demonstrated both the direct and indirect contribution of the retail sector to the Canadian economy. In 2009, retailers contributed $74.2B, representing 6.2% of Canada’s GDP. The retail sector invested an additional $13 B in machinery and equipment, transportation and infrastructure.

In addition, as many multinational retailers consider opening up stores in Canada, we must ensure that payroll and other business costs remain competitive. This will not only impact the number of stores but whether these companies choose to set up their head offices in Canada. As the numbers indicate above, retail head offices create jobs, increase capital investments in the communities they serve and invest in technology.

Given this significant contribution to our Canadian economy, RCC continues to look to the Federal Government to ensure retailers remain viable and competitive across Canada. In support of this there are needed policy changes that will help promote a healthier and more competitive business environment. The most notably issues RCC wishes to bring to the attention of the Standing Committee on Finance include:

· Duty elimination on imported consumer goods, where the duties are no longer needed;

· A regulated, Made-in-Canada debit and credit card system with greater transparency and accountability; and

· Ensure any increase in employment insurance is measured accordingly with industry input.

As an industry that provides a window to the Canadian consumer, (or the storefront to society) addressing these key issues will not only assist retailers in making a greater contribution to the Canadian economy but will also benefit Canadians from coast to coast in all the communities that retailers serve.

Duty Elimination on Imported Consumer Goods

Retailers in Canada have always understood that they are serving customers without borders. More recently, the relative strength of the Canadian dollar, coupled with the entry of several US/international retailers, has meant that Canadian retailers have had to work harder than ever to be competitive and provide value to consumers.

We believe that the government can help reduce costs for retailers by eliminating duties payable on certain imported consumer goods. This would benefit the economy, the competitiveness of the retail market and all Canadians. While many measures have been taken to minimize store closures and layoffs, reduce costs and otherwise lessen the impact of the recession for both Canadian retailers and consumers, eliminating tariff on goods that must be sourced from outside of Canada is an important, and necessary, stimulus that would increase consumer spending.

The elimination of duties on certain finished goods would not come at the risk of Canadian production as the duties proposed for elimination only relates to those goods that are not always competitively priced or available from domestic manufacturers. This measure would also mirror actions recently taken by some of our largest trading partners, including the U.S., where it has been acknowledged that the elimination of unnecessary and outdated tariffs would have a profound and immediate impact on the recovery of the economy and would provide immediate and direct relief to hard working families. For example, to mitigate the effects of the recession on American consumers, U.S. Congress introduced the Affordable Footwear Act and the Miscellaneous Tariff Bill (the former of which saved retailers approximately $700 million in annual duties and translated into estimated savings of approximately $2.5 to $3 billion for consumers).

For Canadians struggling to cope with the current economic climate, elimination of import taxes, many of which are as high as 18%, would provide much needed relief as they attempt to manage their family budgets. The Government needs to ensure that Canadians are able to purchase essential goods at prices competitive with those available across the border. On most items imported into Canada, retailers pay significantly more by way of import taxes to bring goods to market. Canadian retailers have identified a number of mainstream consumer products that are subject to import duties for no reason other than they have never been challenged or captured by international trade negotiations.

Pursuant to section 19 of the Canadian International Trade Tribunal Act, the Minister of Finance has the ability to mandate the Tribunal to provide advice on the availability, or lack thereof, of certain retail products from Canadian manufacturers where the applicable Canadian customs tariff rate of certain retail products is higher than the United States’ MFN general customs tariff rate. Once it is established that sufficient manufacturing capacity for these identified products does not exist in Canada, RCC urges the Government to take action in order for these tariffs to be removed.

Since the introduction of income and sales taxes, the revenue generation capacity of these tariffs has become marginal. While it may be argued that this revenue line has augmented in recent years given the large trade deficit we have with countries such as China, the benefits of lower prices on these goods would mean higher economic stimulus through increased purchasing, higher collection of sales taxes for the public coffer and a decrease in cross-border shopping, keeping Canadian dollars in the Canadian economy. These efforts will go a long way in supporting the interests of hard working Canadian families.

The elimination of import duties on goods that retailers must source outside of Canada would be beneficial to Canadians. Further, in view of our desire to ensure the competitiveness of our retail industry vis-à-vis that of our largest trading partner, we suggest that products which carry a lower MFN duty rate in the U.S. than in Canada also be considered. It is generally understood that the kind of discretionary tariff relief being requested by RCC, on behalf of its membership, would have to be in the public interest, and would not be granted at the detriment to Canadian industry.

Current Request for Tariff relief in Respect of Retail Goods

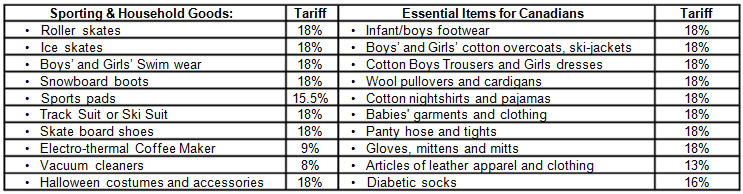

Outlined below is a sample of products that have undue tariffs. Please note that these proposed tariff items are not meant to represent an all-inclusive listing of goods that may warrant consideration for tariff elimination. However, these items are meant to represent some of the least contentious items, based on historical precedent and their everyday use and benefit to consumers, as well as some of the essential products required by working Canadian families.

Taking into account the items noted above, RCC would be pleased to assist the Government in establishing the appropriate terms of reference in the event that the Minister would seek assistance from the Canadian International Trade Tribunal (CITT), pursuant to section 19 of the Canadian International Trade Tribunal Act, in conducting an economic review of our request for tariff relief.

In view of the fact that the retail sector is also facing increased competition, and given that the manufacturing landscape in Canada is constantly changing, it would be preferable that a standing reference for consumer goods be issued to allow for flexible and timely investigations of requests from domestic retailers for tariff relief on imported consumer goods that are not manufactured in Canada.

As you will note form the above table a number of sporting and fitness related products have high tariffs. Given the government’s commitment to address obesity, particularly among young people as part of Curbing Childhood Obesity: A Federal, Provincial and Territorial Framework for Action to Promote Healthy Weights, the removal of these tariffs is an excellent opportunity for this government to support the health and well being of all Canadians. Parents know that regular exercise is a critical part of every child’s development and by removing these tariffs the Government would help to ensure sporting activities are within all family budgets. It would be seen as a win-win for all and would complement the government’s policy initiative outlined under the Children’s Fitness Tax Credit.

Credit and Debit Card Fees

New and Emerging Technologies

In the not too distant future, many Canadians will no longer carry a wallet. All of their payment information will be loaded onto their mobile device. While retailers appreciate that this technology could enhance the shopping experience, merchants are very concerned about the impact on their costs and their unpredictability. The monopolistic nature of the credit card companies allows them to incentivize processors to use their technology. Since the banks make greater profits from the card companies rather than Interac, our cost-effective Made-in-Canada debit system, they often promote credit cards at the expense of Interac debit. This will in turn lead to increased costs for merchants since debit transactions are a flat fee rather than an ever increasing percentage of the sale.

The Voluntary Code of Conduct

Even in the current environment, with the Voluntary Code of Conduct for the Credit and Debit Card Industry, our members are telling us loud and clear that the main thing that the code accomplished is that it shined a light on the practices of the payments industry in Canada and made it clear to retailers that there is no real competition in the marketplace. The only competition that exists is among the banks to provide customers with greater incentives (thus more expensive payment products used at point-o-sale) on the backs of merchants.

RCC conducted a member survey in April, 2011 to track our members experience with the Code. What we heard from our merchants is that the payments industry has continued to engage in practices that resulted in high fees that have no connection to the service provided and some players have blatantly violated the voluntary code.

While Retail Council of Canada is an active participant in the Canadian Payments Task Force, which was established by the Minister of Finance, it understands that many of the recommendations that will find their way in the final report may take time to see the light of day.

RCC would thus recommend that the Code of Conduct for the Credit and Debit Card Industry be revised to include provisions regarding new forms of payment such as mobile and contactless payments.

Rising Merchant Costs

With the ever increasing number of premium cards in the marketplace, which carry a higher processing fee, it is not just merchants and their consumers that are impacted. The federal and provincial governments, their agencies and the MUSH sector offer many government services that can be paid with a credit card. This effectively translates to taxpayer dollars subsidizing multinational card companies and financial institutions.

PCI Compliance

As noted in the recent Payments Task Force Report “The Way We Pay: Transforming the Canadian Payments System” the introduction of new technology and standards has added costs for merchants. “Chip and Personal Identification Number (chip and PIN) technology, which is expected to reduce fraud by using embedded microchips to facilitate authentication, required merchants to make expensive system changes. According to RCC, the cost of implementation and integration borne by merchants is in excess of $1 billion. In addition, merchants have had to comply with the Payment Card Industry Data Security Standard (PCI DSS), thus incurring additional costs.”

The Solution

Minister Flaherty indicated when the Code was introduced that he would be prepared to look at other options if the Code was violated. We believe that the time has come for to move beyond the Code to ensure flat merchant fees for debit card transactions, the elimination of higher merchant fees for premium credit card transactions, real competition for merchant acceptance and a formal stakeholder-driven mechanism for all elements of the Canadian payments system, including new and emerging technologies.

The following 4 elements should form the basis of a new payments system:

1. A regulated Made-in Canada framework that preserves our low-cost debit system and allows for enhanced competition and greater transparency and accountability;

2. Cost certainty and clarity must be underlying principles of Canada’s payments system so that merchants can manage costs associated with debit and credit card transactions. Costs that are currently built into the system must be fairly aligned with services provided;

3. The new framework must function across all future technological platforms; and

4. Security for consumer financial information to ensure that there are common rules and standards across payment instruments.

Employment Insurance Premiums

Collectively, the retail sector is the largest employer in Canada, providing jobs for more than 2 million Canadians generating sales in excess of $300 billion dollars a year. The retail sector continues to be a critical component of Canada’s economic recovery. The employment that our sector generates will be a key indicator of whether Canada can weather the latest economic downturn. Many of our member companies, including multinational companies that are making substantial investments in Canada, are currently making employment decisions and ongoing payroll tax increases will not encourage investment in job creation.

RCC was concerned by Minister Flaherty’s recent suggestion that EI premiums will increase and that the oneyear incentive to encourage small businesses to hire new employees will not be extended. Any review of the EI system must take a holistic view that looks at premiums and the growing number of benefits that are made available to employees. Employers want to be able to offer their employees fair and reasonable benefits, but currently decisions about providing and/or extending benefits are made by governments and employers are then faced with increased payroll costs and are not consulted sufficiently.

A review that takes into account the relationship between increased premiums and increased benefits will provide businesses with a greater incentive to retain current employees and to add jobs in the future, which is critical to stabilizing the country’s economy. RCC encourages this Government to only proceed with additional increases both in terms of cost and benefit of Employment Insurance once it has consulted broadly with industry to ensure they are manageable and warranted.

Conclusion

Retail is one of Canada’s most important economic engines. It remains Canada’s largest employer, providing jobs for more than 2 million people. Canadian merchants, both big and small, will continue to be a critical component of Canada’s economic recovery. As the government proceeds with its 2012 budget decisions, RCC encourages the prioritization of the recommendations outlined above. By working to address these issues, the government can greatly improve the business conditions in which Canada’s merchants operate. This will inherently support Canada’s continued efforts towards greater economic recovery and will benefit all Canadians as they strive to stretch their personal and family budgets.